Canada’s relationship with the United States has hit a rough patch after months of improved ties under Prime Minister Mark Carney. The 60-year-old former banker, who took office in April, seemed to earn the respect of U.S. President Donald Trump, a 79-year-old businessman, setting the stage for constructive trade talks. However, Canada’s new digital services tax has thrown a wrench into those efforts, prompting a sharp rebuke from Trump.

The tax, set to begin on June 30, 2025, imposes a 3% levy on revenue from Canadian users of major tech companies, including U.S. giants like Amazon, Google, Meta, Uber, and Airbnb. Applied retroactively from 2022, it’s expected to cost these firms $2 billion. On June 27, 2025, Trump posted on Truth Social, calling the tax a “direct and blatant attack” on the U.S. and accusing Canada of following Europe’s lead with similar taxes, which he’s also contesting.

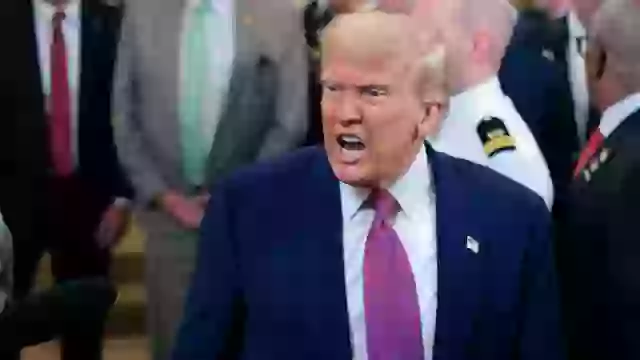

Trump announced he was immediately stopping all trade negotiations with Canada and would introduce new tariffs on Canadian goods within a week. He also criticized Canada’s high tariffs on American dairy products, which can reach 400%, as a long-standing trade barrier. The move came as a surprise, especially after Carney and Trump agreed at the G7 summit to work toward a trade deal by mid-July, raising optimism for a resolution.

Carney responded about an hour later with a calm but firm statement to reporters. “We’ll keep pushing forward with these complex negotiations to protect Canadian interests,” he said, showing no intention of backing off the tax. Trump later told reporters in the Oval Office that the U.S. holds significant economic power over Canada and suggested Canada might drop the tax, though he added, “It doesn’t matter to me.”

Daniel Beland, a political science professor at McGill University in Montreal, said the tax, passed a year ago, has been a known irritant. “It’s a domestic policy, but it hits U.S. tech companies hard, so it’s been a sore spot,” he explained. Beland suggested Trump’s dramatic response, timed just before the tax’s start, is a tactic to pressure Canada during uncertain trade talks, creating challenges for both nations.