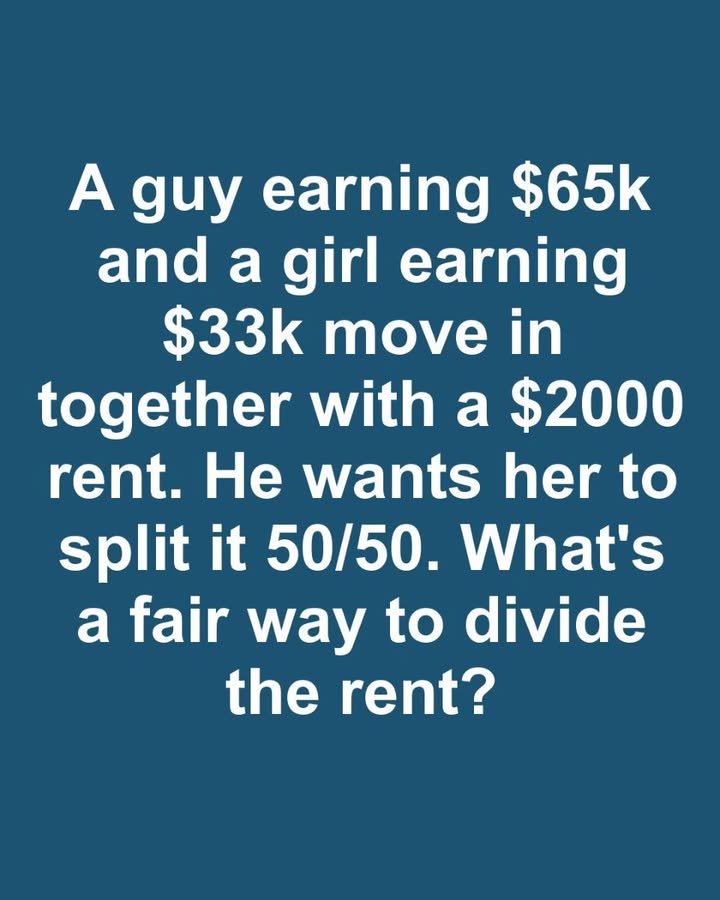

When couples move in together, it’s an exciting new chapter, but splitting expenses like rent can be tricky, especially when incomes vary. Imagine a couple where one earns $65,000 a year and the other $33,000, with a monthly rent of $2,000. Finding a fair way to divide it ensures both feel valued and supported, setting the stage for a happy home life.

Splitting rent evenly at $1,000 each might seem straightforward, but it can strain the lower earner, who pays a larger share of their income. A fairer method is to base rent on their income proportions. With the higher earner making about 66% of their total income, they could pay $1,320, while the other covers $680. This keeps contributions affordable, preventing financial stress and fostering balance.

Another approach is for each to pay a fixed percentage of their income, like 30%, so the higher earner pays around $1,625 and the other $825. Alternatively, an even rent split could be paired with the lower earner taking on more household costs, like groceries or utilities, to share the load equally. This mix of financial and practical contributions can work well if both agree on their roles.

Open communication is essential. Talking honestly about earnings, debts, and spending limits builds trust and avoids resentment. Beyond rent, couples need a plan for shared expenses like internet, food, or entertainment. Dividing these by percentage, alternating months, or assigning specific bills keeps things organized and fair, reducing the risk of money-related arguments that can harm a relationship.

A cohabitation agreement can also offer peace of mind, outlining who pays what and how shared items are handled if the couple parts ways. There’s no single right way to split rent, but the goal is a system that feels fair and sustainable. By prioritizing empathy and teamwork, couples can create a financial plan that strengthens their bond and makes their shared home a place of comfort and understanding.